We scour the online world for reviews from perfectly-recognised means. Every supplier is evaluated depending on the quality and amount of their reviews, their existence on various overview web pages, as well as their regular minimal rating.

Challenging funds lenders: They're personal firms who provide mortgages. Their loans often have significant origination expenses and significant desire costs. These quick-term financial loans are well known amid house flippers, as They are a lot quicker to amass.

The most crucial process for the prospective homeowner seeking a preapproval letter is to gather the many financial paperwork needed to give the lender a reliable image within your earnings, debts and credit history record.

Alternatively, lenders that operate only online, are inclined to offer decreased mortgage rates as they have significantly less fastened prices to deal with.

We seek the services of secret shoppers to connect with our suppliers anonymously and Consider them. Vendors who react rapidly, answer thoughts totally, and communicate politely rating better.

Also, don’t forget closing expenses, which might be the charges you’ll pay out to finalize the mortgage. They generally operate in between 2 to five % in the bank loan’s principal.

We employ the service of secret shoppers to get in touch with our suppliers anonymously and Assess them. Companies who answer rapidly, reply issues extensively, and converse politely rating bigger.

Zillow chief economist Skylar Olsen. “I’m expecting mortgage fees to be a tiny bit less risky in 2024 and, facts surprises aside, continue to slowly relieve down about the system on the calendar year.”

Initial, start by evaluating charges. You'll be able to Look at premiums online or simply call lenders to get their recent average rates. You’ll also want to check lender expenses, as some lenders demand over Other folks to course of action your bank loan.

Applying for any mortgage by yourself is straightforward and most lenders provide online applications, which means you don’t must travel to an office or branch spot.

The most beneficial financial loan delivers go to borrowers with credit history scores during the 700s. That’s due to read more the fact a robust score demonstrates you can responsibly manage your credit card debt.

Our editorial crew gets no direct compensation from advertisers, and our articles is completely actuality-checked to make certain precision. So, whether or not you’re studying an post or an evaluation, you are able to belief that you choose to’re finding credible and dependable details.

We employ mystery customers to phone our providers anonymously and Consider them. Vendors who reply quickly, reply thoughts completely, and converse politely rating higher.

Methods to get ready for obtaining a mortgage contain recognizing Whatever you can realistically afford to pay for, saving for a down payment and enhancing your credit rating.

Jaleel White Then & Now!

Jaleel White Then & Now! Tatyana Ali Then & Now!

Tatyana Ali Then & Now! Danielle Fishel Then & Now!

Danielle Fishel Then & Now! Barbi Benton Then & Now!

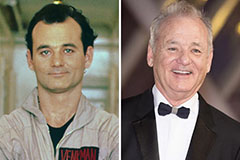

Barbi Benton Then & Now! Bill Murray Then & Now!

Bill Murray Then & Now!